I haven’t done budgeting since November 2022 (9 months!). Mainly because I’m

out of track.

Before getting out of track, I’ve been consistently doing it for the past 5

years.

I’ve attempted twice to get my budget in order, but the backlog is just too

much. There’s a lot to account for, there’s a lot to tally. After spending

several hours hours backtracking, I gave up.

Fresh start

YNAB has this

concept of not caring about past expenses. There’s nothing you can do with

money already spent.

Even though it’s good to have 5 years worth of data, it’s only a nice-to-have.

If I continue to operate without a budget, I’m risking myself to be in a

position where I anxiously wait when my next paycheck will be. Kahig-tuka ba.

Another side-effect is it’s also getting incredibly difficult to make big

financial decisions without knowing where I stand financially.

I decided to let go and do a fresh start.

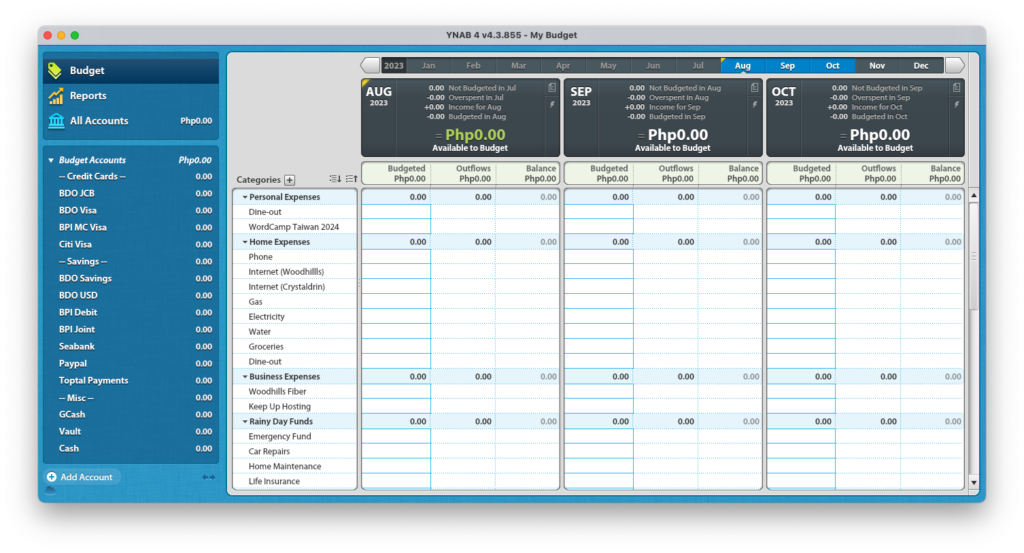

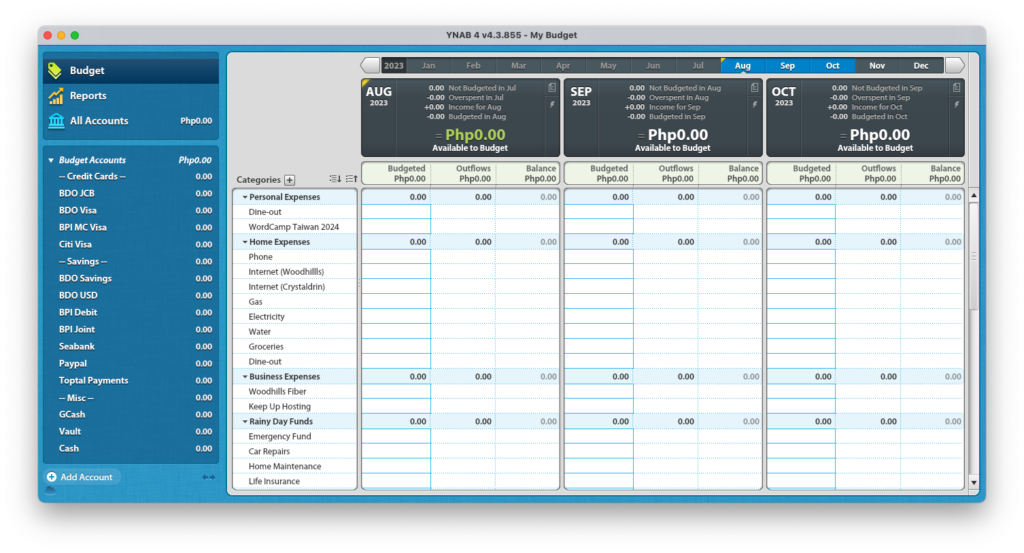

Switching back to Classic YNAB

Since I’m going to start fresh, it’s a perfect time to switch back to Classic

YNAB.

I love YNAB methodology. It fits my thinking. It helped me manage my money when

I started earning.

Over the years, the company behind YNAB changed and they pivoted the product to

one-time purchase to a monthly subscription. I had no problem with it,

especially with a grandfather’ed pricing where I got a discounted monthly fee.

I’m happy to pay because it literally changed how I think about money.

A couple of years more, they increased the price twice. It felt like they lock

you down with their methods, and leave you no choice but to accept their

pricing change.

It’s been on my list to move out of YNAB. I was looking for something that I

can use in my lifetime. I tried Firefly III (an

open-source alternative but with different methodology),

GnuCash (another open-source alternative), but the

YNAB method is already ingrained in me.

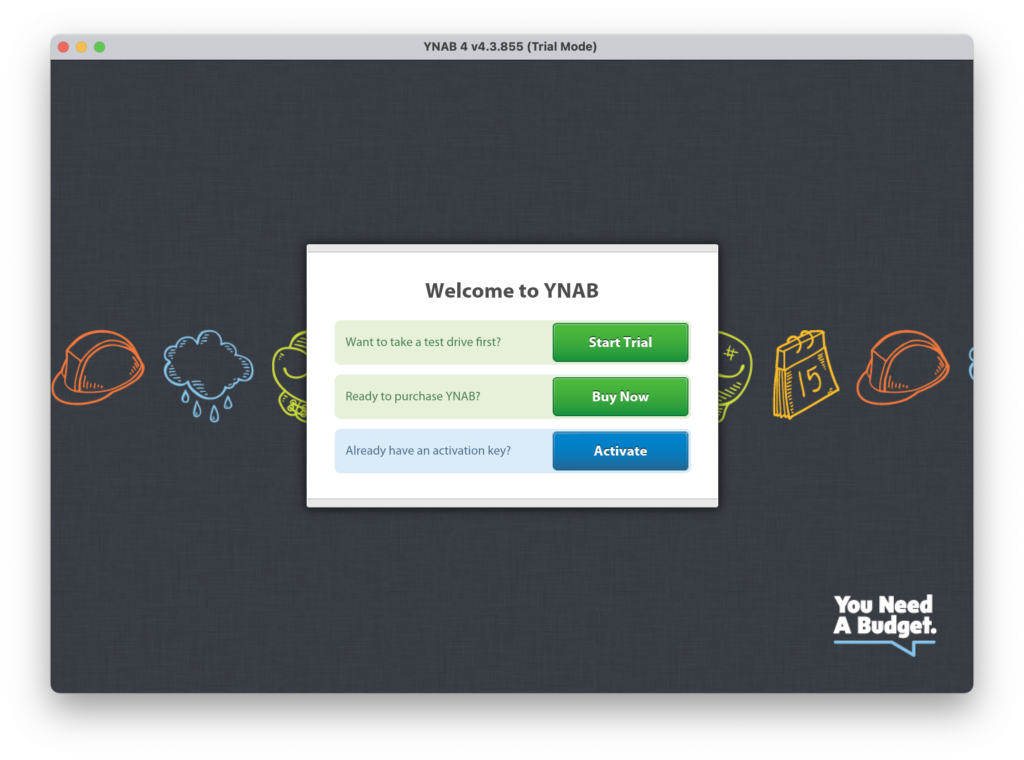

Luckily, I’m not alone feeling this way. The community made the classic YNAB 4

work on a modern OS.

Knowing for a fact that it will not change (it hasn’t been updated since 2019)

gives me confidence it will still work for the foreseeable future. I can build

my budgeting process without getting affected on any change of direction of the

company behind it.

Y64

Y64 provides a bash script that will

download the latest YNAB 4 and the latest Adobe AIR 64-bit runtime and compile

it to a working app. Running the script will output a working YNAB 4 app.

The app itself aged like a fine wine. It’s still perfectly usable and does not

feel old.

License

YNAB does not sell license anymore for the classic YNAB. Since it’s already

unsupported, the way to workaround this is to adjust the trial mode end-date by

editing the license file.

Mac:

~/Library/Application\ Support/com.ynab.YNAB4.LiveCaptive/Local\ Store/.lic

Windows:

%APPDATA%\com.ynab.YNAB4.LiveCaptive\Local Store\.lic

Edit the date and save.

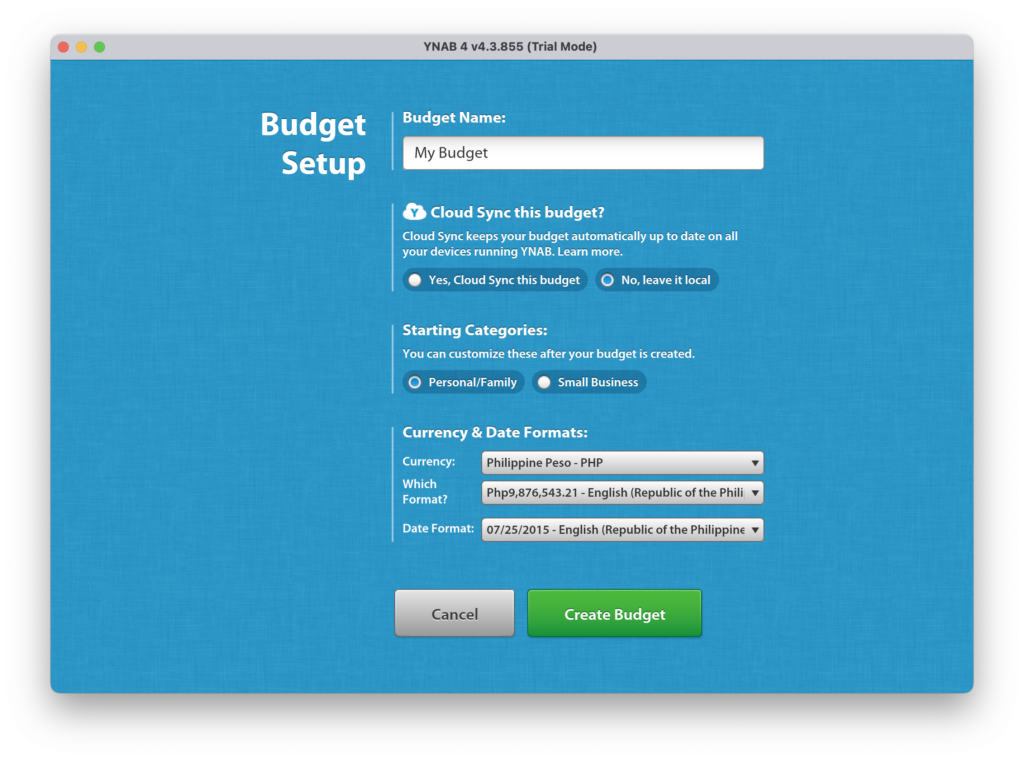

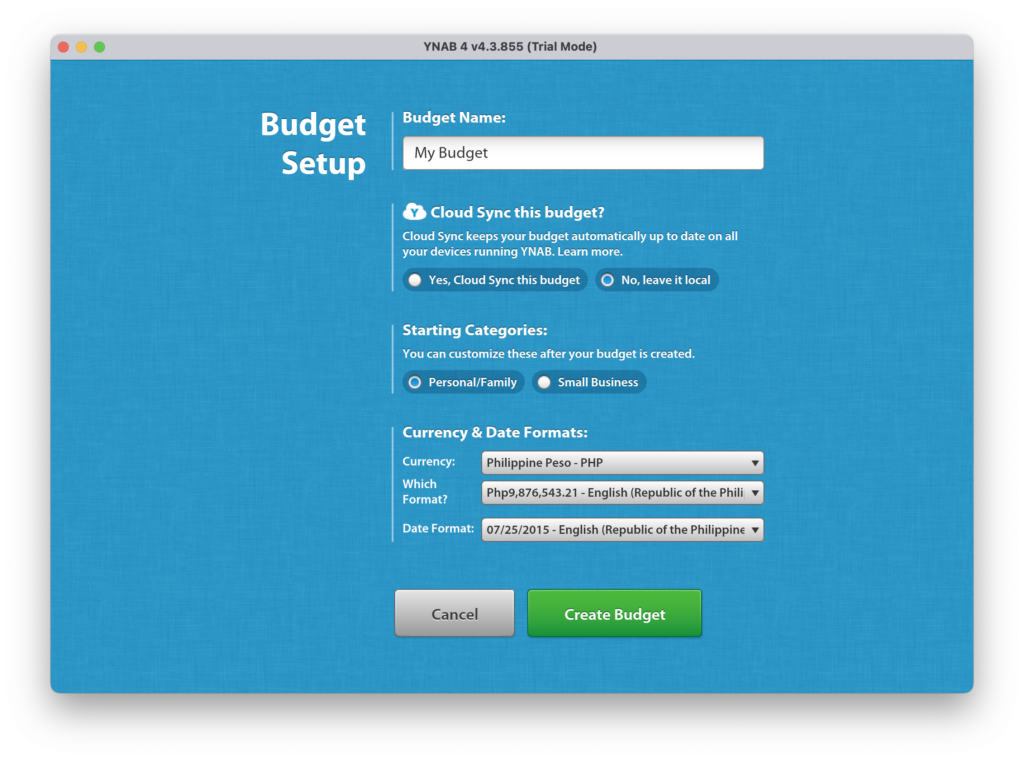

Starting fresh

With all this prepared, I’m now in a good position to make a fresh start.